Life Insurance Infographics

Originally Posted by Infographics Zone

Life Insurance Cheat Sheet

Life insurance is designed to replace lost income or pay for special needs your family would have if you weren’t around. Print out this cheat sheet with basic questions on life insurance to use as a handy guide in helping determine if you need insurance, and what they best fits your life.

Source: bankrate

Life Insurance Facts and Figures

Life insurance provides financial protection in lieu of specified premium. It is a kind of insurance wherein life itself gets protected from the uncertainties and unexpected incidents in one’s life.

Source: wholetermlifeinsurancequotes

What you need to Know About Life Insurance

If you’re stay-at-home parent, you may not provide an actual paycheck for the household, but you do provide services that would cost tens of thousands of dollars to replace. 41% of life insurance shoppers said life events – getting married, having or adopting a child, or buying a home – promoted them to shop for life insurance.

Source: efinancial

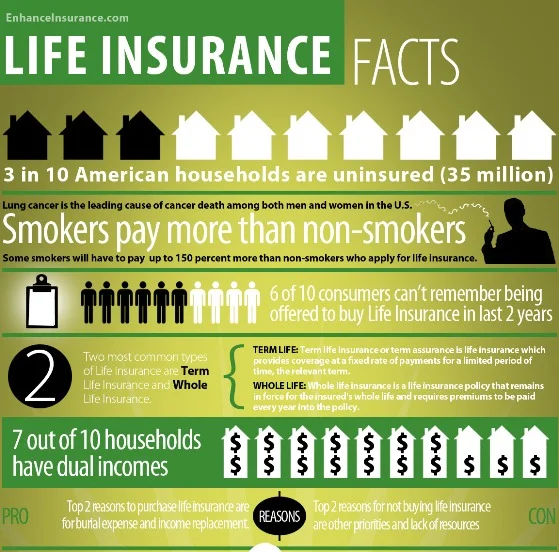

Life Insurance Facts

3 in 10 American households are uninsured, 6 of 10 consumers can’t remember being offered to buy life insurance in last 2 years. And 7 out of 10 households have dual incomes.

Source: enhanceinsurance

How much do you Know about Life Insurance?

Generally, life insurance payouts resulting from death of the insured are excluded from the beneficiary’s income and not subject to tax. “Life insurance proceeds paid to you because of the death of the insured person are not taxable unless the policy was turned over to you for a price.”

Source: hrblock

How to get Life Insurance

Lifeline direct insurance services show consumers how to get online life insurance quotes.

Source: lifelinedirectinsurance

Do I Need Insurance

New investigation completed in 2012 got to light a number issues surrounding financial stability when it comes to being insured. The report revealed: Only 64% of Australian’s could meet their mortgage payments in the incident of a death. 47% of Australians would NOT cope if their partner died. While shocking we know that 52% of people who take out income protection insurance are afforded piece of mind and 77% really believe that it is incredibly important to safeguard their assets.

Source: lifebroker

Life Insurance 101

Make cash available to your family immediately upon your death; pay any debts you may leave behind. Pay for final expenses and estate taxes, leave money to your heirs.

Source: divacfo

Life Insurance through the Ages

Life insurance generally is cheaper and easier to get when you’re younger. So don’t wait until you’re just young at heart to get covered.

Source: matrixdirect

[Editor's Cut from Original Post]